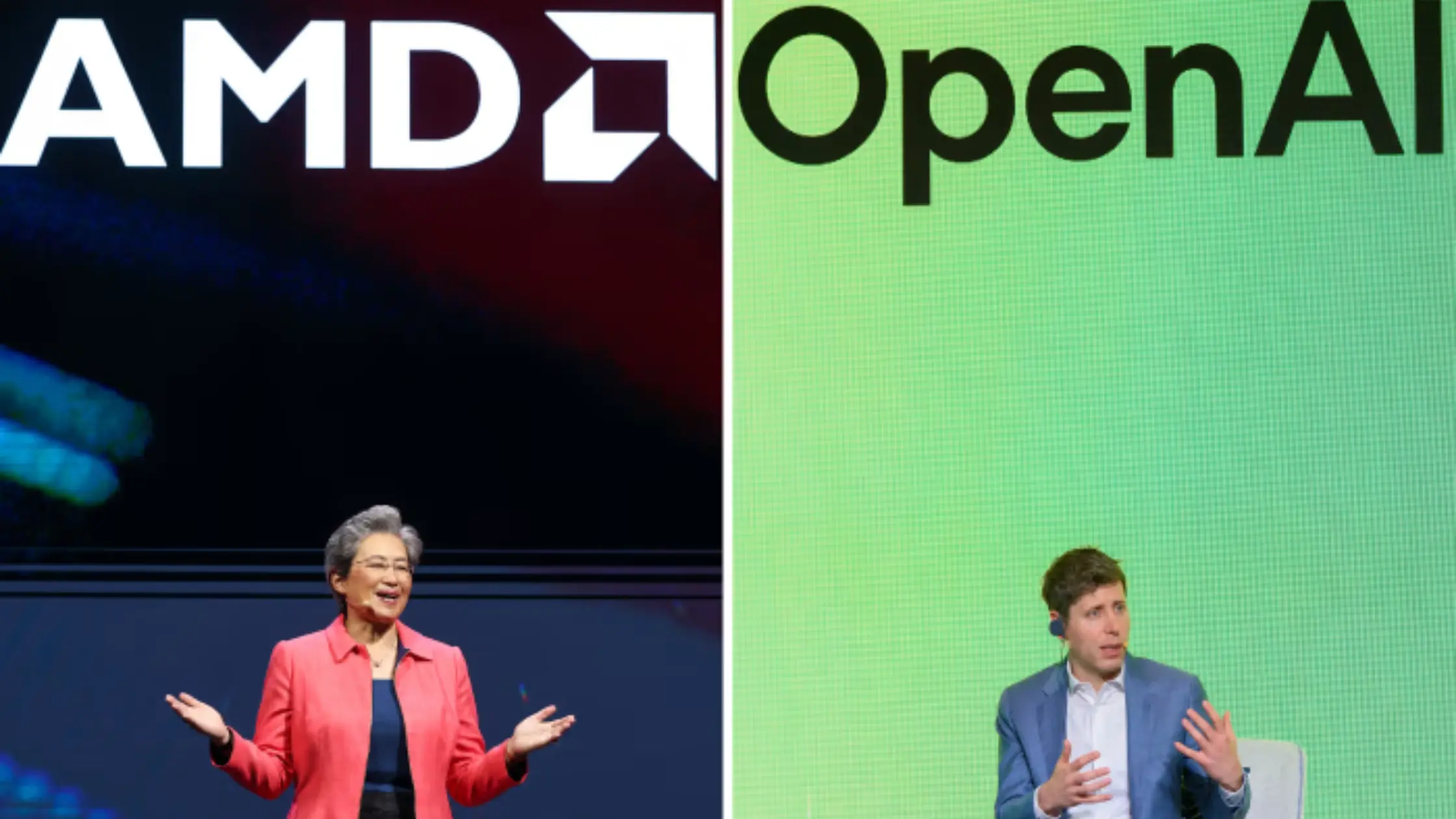

“7 Game-Changing Facts About the Open AI–AMD Deal That Could Give Altman 10% of AMD”

Open AI has struck a landmark AI infrastructure deal with AMD to deploy 6 GW of Instinct GPUs and acquire up to 10% of AMD via warrants. Learn how this reshapes the AI chip landscape, impacts stock markets, and accelerates compute scale. The Open AI and Advanced Micro Devices (AMD) partnership marks one of the most ambitious compute deals in AI history. Under this agreement, Open AI will deploy up to 6 gigawatts of AMD’s Instinct GPU infrastructure over multiple generations—and, remarkably, obtain an option to acquire up to 10% stake in AMD via warrants. The move reflects how critical compute capacity has become to scaling generative AI, and signals a new era of vertical integration between AI developers and chipmakers.

Within this article, we unpack the full strategic significance of the Open AI–AMD deal, analyze its financial and technical mechanics, assess reactions from markets and competitors, and explore implications for the future of AI infrastructure.

Table of Contents

- Background & Context: AI’s Insatiable Compute Demand

- Deal Structure: GPU Deployment and Equity Warrant

- Financial & Market Reaction

- Technical Roadmap & Deployment Timeline

- Strategic Motivations — Why Open AI Picks AMD

- Risks, Challenges & Competitive Dynamics

- Long-Term Implications for AI Infrastructure

- Conclusion

1. Background & Context: AI’s Insatiable Compute Demand

The AI compute bottleneck

Modern generative AI (like large language models, multimodal models, etc.) is bottlenecked by compute infrastructure. Every new model iteration demands exponentially more computing power, memory bandwidth, and efficient scaling across data centers. Without massive, reliable hardware supply, feature rollouts stall. Greg Brockman, Open AI’s president, recently said that many revenue-generating features in Chat-GPT are held back simply by a lack of compute. (Business Insider)

Historic reliance on Nvidia

Until now, Nvidia has dominated GPU supply in AI. Open AI’s earlier $100 billion equity-plus-supply pact with Nvidia reaffirmed that dominance — Nvidia invested back in Open AI and gained a major role in its hardware roadmap. (AP News) However, placing too much reliance on one supplier is risky in supply chain, pricing, and innovation dynamics.

The rise of AMD’s Instinct line

AMD’s Instinct GPU line (MI series) has been evolving rapidly to close gaps with competitors. The Instinct architecture is specifically engineered for data center and AI workloads. (Wikipedia) Previous collaborations (e.g. MI300X, MI350X) laid groundwork for this deeper partnership. (Open AI)

Combining Open AI’s demand and AMD’s hardware momentum sets the stage for a possible shift in AI compute supply dynamics.

2. Deal Structure: GPU Deployment and Equity Warrant

GPU commitment: 6 GW over multiple generations

Under the definitive agreement, Open AI will procure and deploy 6 gigawatts of AMD Instinct GPUs over several generations. The first 1 GW tranche is expected to go online in second half of 2026. (Advanced Micro Devices, Inc.)

These GPUs will scale across multiple hardware generations (starting with MI450 series) to optimize performance, power, and workload efficiency. (Open AI)

Warrant: Option to acquire up to 160 million AMD shares

To align incentives, AMD grants Open AI a warrant on 160 million shares of AMD common stock. These warrants vest in tranches linked to deployment milestones (starting at the first 1 GW) and tied to AMD share price targets and Open AI’s technical/commercial success in scaling. (OpenAI)

If fully exercised, the warrant corresponds to roughly 10% ownership of AMD (based on current share counts). (Reuters)

Some reports say the warrant is structured such that the share exercise price is extremely low, contingent on hitting high share price targets (even as high as $600 per share in some versions). (Reuters)

Financial valuation and non-disclosed sums

Both companies have declined to disclose the precise dollar value of the transaction. However, media and analyst estimates suggest the deal is worth “tens of billions” in total revenue to AMD over its duration. (TechCrunch) Some insider commentary pegs possible revenue over four years from Open AI and its ecosystem at over $100 billion. (AP News)

3. Financial & Market Reaction

AMD stock surge

Following the announcement, AMD’s stock jumped 23 % to 25 % in one session. Some press even report gains above 30 %. (Reuters) This reflects investor confidence in AMD’s positioning in AI compute and validation of its roadmap.

Nvidia and broader chip sector ripples

Nvidia shares dipped slightly (around 1 %) on the same day, likely because the Open AI-AMD deal signals diversification away from pure Nvidia dependency. (AP News) Some analysts view this not as a direct blow to Nvidia but rather a reflection of how enormous the compute demand is across multiple chip vendors. (WIRED)

Analysts’ take

Analysts see this as not just incremental revenue, but a structural shift:

- It validates AMD’s AI compute roadmap and gives it a flagship marquee customer. (TechCrunch)

- It downgrades the risk of AMD being “just a trailing GPU contender” and elevates it as a strategic AI infrastructure player. (WIRED)

- Some caution about execution risks, capital intensity, and stock dilution effects if the warrants are exercised.

4. Technical Roadmap & Deployment Timeline

Phase 1: MI450 deployment (1 GW, 2H 2026)

The first deployment tranche will use AMD Instinct MI450 GPUs, projected to be the next-generation architecture succeeding MI350X. (OpenAI) The goal is to build efficient rack-scale AI clusters optimized for performance-per-watt. (www.guru3d.com)

Multi-generation scaling

Over time, OpenAI will adopt subsequent Instinct generations as AMD refines architecture, power efficiency, memory bandwidth, and software co-optimization. (Open AI) The two companies will coordinate roadmap alignment so that deployments remain efficient across generational transitions. (Open AI)

Infrastructure & data center buildout

This GPU deployment will integrate with Open AI’s Stargate project—its global datacenter expansion effort. The first Stargate site in Abilene, Texas is already operational using Nvidia GPU infrastructure; future sites (in New Mexico, Ohio, Midwest) are likely to incorporate AMD hardware in a mixed-supplier model. (Open AI)

Performance targets & milestones

Vesting of the warrant tranches is tied not only to GPU volume deployment but also to share price thresholds and technical/commercial milestones (e.g. yield, cluster stability, cost-of-power metrics). (Open AI)

The complexity lies in aligning hardware, software, operations, and financial metrics across multiple years—a nontrivial systems engineering challenge.

5. Strategic Motivations — Why Open AI Picks AMD

Diversification of supplier risk

Relying wholly on Nvidia would create risk in pricing, supply, and bargaining leverage. The AMD tie-up diversifies OpenAI’s compute supply chain. (AP News)

Better alignment and incentives

By giving Open AI an equity warrant, AMD becomes more than just a vendor — it becomes a strategic partner with shared upside. This aligns interests in pushing performance, efficiency, and scale.

Co-optimization potential

Because Open AI and AMD will coordinate on hardware-software optimizations across generations, the partnership may yield performance or cost advantages that are hard to replicate with off-the-shelf vendor relationships.

Ecosystem positioning and signaling

For AMD, winning Open AI as a marquee AI partner bolsters its credibility in the AI compute race. For Open AI, this signals ambition to be more than an AI model developer — to be a foundational infrastructure integrator.

Capital markets and valuation mechanics

The warrant structure gives Open AI optionality without upfront dilution, while providing AMD potential capital injection (upon exercise). Over time, if AMD’s share price appreciates, Open AI could secure a significant stake. This interweaving of compute buy and equity stake is emblematic of the circular economy evolving in the AI industry. (WIRED)

6. Risks, Challenges & Competitive Dynamics

Execution and scale risk

Deploying a gigawatt-scale GPU infrastructure is nontrivial: cooling, power, interconnects, reliability, operations, yield, cluster orchestration—all need to scale. Slippages or bottlenecks could derail timeline and performance.

Capital intensity

The cost per gigawatt for building data center infrastructure (power, racks, cooling, interconnect) is massive. Estimates suggest $50 billion per GW in construction costs (or similar ballparks). Open AI and its partners are committing huge capital. (WIRED)

Warrant dilution & governance

If Open AI fully exercises the warrants, AMD could see dilution or changes in governance dynamics. Shareholders will closely watch the terms, especially share price triggers and vesting hurdles.

Competitive pressure from Nvidia and custom silicon

Nvidia remains a dominant force and is likely to accelerate its roadmap, reduce margins, or bundle advantages. Moreover, Open AI is reportedly in talks with Broadcom to build custom chips for future generations, which adds uncertainty to the long-term AMD stake. (Reuters)

Market, regulatory, and geopolitical risk

Semiconductor supply chains are sensitive to regulation, export controls, geopolitical tensions, and fab capacity constraints. A disruption in chip fabrication or sanctions could ripple through.

Interdependency fragility

The deal creates tightly coupled dependencies: failures or cost overruns in one leg (compute, software, capital) could propagate across the partnership. Analysts caution that such circular economies (compute, capital, equity) are powerful but brittle. (WIRED)

7. Long-Term Implications for AI Infrastructure

Shift toward vertically integrated compute platforms

This deal illustrates how future AI platforms may not rely purely on cloud/hardware vendors but integrate compute, models, and data center operations under one roof.

Greater competitiveness for AMD

If the deployment is successful, AMD could leapfrog into a top-tier AI compute brand rather than being a distant second or third.

Pressure on rivals to structure deeper compute-equity tie-ups

Other chip vendors or custom silicon firms may offer more integrated terms (equity for supply, co-development) to win marquee AI clients.

Democratization & cost optimization

Scale, efficiency, and co-optimization may bring down unit cost of AI compute, enabling more players to enter generative AI markets.

Market consolidation and ecosystem realignment

Interdependencies among AI firms, semiconductor firms, infrastructure builders (like Oracle or cloud providers) may lead to realignments, partnerships, and consolidation in the AI stack.

8. Conclusion

The Open AI and Advanced Micro Devices (AMD) deal is one of the most consequential compute partnerships in the history of AI. With a commitment to deploy 6 GW of AMD’s Instinct GPUs and an option for Open AI to take up to a 10% stake in AMD, the agreement blurs the lines between demand side and compute supply side in AI.

While the financial terms remain undisclosed, market reactions and analyst commentary suggest belief in its structural importance. The partnership both validates AMD’s roadmaps and enables Open AI to de-risk its supply chain. Execution risk, capital intensity, and competitive dynamics remain significant, but if this succeeds, it could reshape how AI infrastructure is built, financed, and governed.

This deal is not simply a vendor contract: it’s a strategic bet on compute’s centrality to the future of artificial intelligence—and a new model of integration between AI firms and chipmakers.